Mayer Brown defense partner Michael E. Lackey said litigation finance “was just anathema” to him about a decade ago.

“Anything that makes it easier for people to sue my clients is something I don’t want,” Lackey said in an interview. Now, “virtually every large law firm that does litigation probably has a funded case somewhere”—including his.

The biggest US law firms have grown comfortable with the practice of using investments from third parties to pay the cost of lawsuits. In return, the investors get a piece of any successful court awards or settlements and benefit from returns uncorrelated to equity markets.

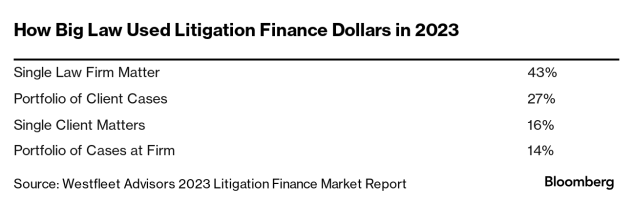

Big Law has helped build litigation finance into a $15.2 billion industry, up from $9.5 billion five years ago, according to Westfleet Advisors. The 200 largest US law firms by revenue accounted for more than a third of total capital commitments in two of the past three years, Westfleet found.

Quinn Emanuel Urquhart & Sullivan in April announced a $40 million deal with Longford Capital to finance lawsuits for private equity firms and their portfolio companies. Saul Ewing has about four funded matters and does due diligence for multiple litigation funders—a change from years ago when the firm and others in Big Law cast a suspicious eye at the practice.

“My firm was somewhat reluctant to embrace litigation funding,” said Casey Grabenstein, a Saul Ewing partner for commercial litigation and co-chair of the firm’s litigation funding group. “Now they’re fully on board. You have a wave of newer partners who are open to creative solutions like litigation funding that are really pushing it within their firms.”

Lowering Risk

The large firms’ comfort has stemmed from a better understanding of the industry and a desire to take on more contingency cases without assuming the risk if the lawsuits are losers. Patent litigation accounted for 19% of new capital commitments last year, Westfleet found. Firms said antitrust and international arbitration were also popular areas for litigation finance.

The funding is useful in expensive, long-duration international arbitrations, said Martin Gusy, a partner at Bracewell who handles such cases.

“It’s client driven,” Gusy said. The customers sometimes lack the capital to pursue matters or in other cases simply want to avoid the high costs of arbitration, he said.

“Clients are becoming more sophisticated and they’re demanding better deals,” said Michael Bowe, co-chair of the litigation and dispute resolution practice at Brown Rudnick. “There’s pressure on bigger firms to compete.”

Cadwalader uses the funding for all contingency cases, said Phil Iovieno, co-chair of the firm’s antitrust litigation group, who typically handles cases with $10 to $20 million budgets. The firm has several contingency cases with funding and he only works with a select group of funders who are comfortable with large budgets, despite getting solicitations for funding nearly every week, he said.

“We’re not turning a contingency case into a billable case, we are sharing the risk with the funder,” Iovieno said. “You pick your funders carefully—you just have better outcomes.”

Best Practices

Westfleet over the past year and a half has seen an increase in inquiries from Big Law firms about navigating litigation finance, said Charles Agee, the firm’s chief executive.

“There are many benefits of funding, but there are also some real downsides—some ethical issues, conflict issues,” he said describing the content of the inquiries he receives. “We see the need to institutionalize some best practices around it.”

Saul Ewing’s Grabenstein said it’s best that funders be “hands off” on case strategy. “You can run into problems with funders who want to control the terms of settlement,” he said.

Shawn Blackburn, a Susman Godfrey partner who has litigation funding behind at least half of his intellectual property cases, said the investor’s return shouldn’t take too much from the patent owner. Otherwise clients may say “I’m not going to get any of this money” and press for an unnecessary trial rather than take a settlement, he said.

Blackburn said he refers clients to multiple funders because he doesn’t want to be in a position of funneling people to just one. He said he also doesn’t get involved in negotiations between the client and funder.

“You want to make sure that it is their choice and that they are themselves going out and getting the best deal,” he said.

Brown Rudnick’s Bowe said firms that use litigation finance must be prepared for the large amount of time it takes to get funding—at times several months—with a low probability of being approved. “That’s a really big cost and it can be off-putting to a client,” he said.

Bowe said he’s increasingly interested in using the insurance industry to fund cases because it is less cumbersome and expensive than litigation finance.

“Over time this industry is going to continue to become more and more efficient and have more and more products and be much more sort of consumer friendly to law firms,” he said. “That’s very exciting.”

Lackey of Mayer Brown said funders’ claim that they even the playing field is true.

“It does present opportunities for our clients to bring case that they otherwise couldn’t bring,” he said. “When used in that form, I find it to be a very useful tool.”